What is ISF and why is it required?

UK banks introduced a new way of clearing cheques in October 2017 whereby the image of a cheque is now scanned and processed rather than the traditional physical cheque clearing method.

This has made the cheque clearing process much faster and allowed other advances such the scanning and processing of cheques via mobile phones for some banks. Due to this increase in cheque fraud the banks are now requesting that Image Survivable Features (ISF) are added to all cheques.

Video - How ISF works

There are two different options depending on how you print your cheques. Both options provide a different level of security.

Option 1 – UCN

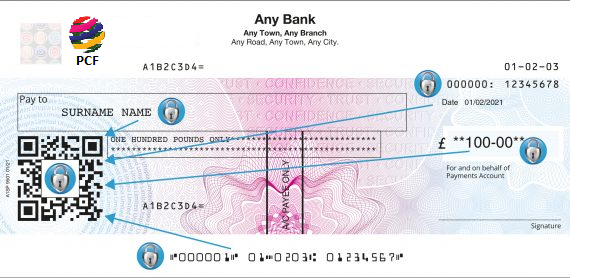

UCN stands for Unique Coded Number. It is an ISF consisting of an encrypted code number printed on the face of the cheque. We encrypt the individual Cheque Number, Sort Code and Account Number into an alphanumeric string using a highly secure encryption algorithm which is printed onto the cheque in two designated positions. The UCN is always printed in two locations to ensure capture even if a receipt stamp has been used or it is otherwise obscured. (see sample cheque image) If you have no MICR line printed cheques banks are expecting UNC+ below. UCN can be added via software or we can produce the base paper with UNC number where the MICR line is preprinted.Option 2 – UCN Plus ®

UCN Plus offers the highest level of protection when clearing the digital image of a cheque. The difference is that UCN Plus can only be added at the time of print production where the MICR line and the Payee details are added to the cheque. The payee and the amount payable are included within high level security encryption process. This then appears on the cheque as a QR code. However, the QR code cannot be read by a standard QR code scanner and can only be read by scanners that have the encryption key. The cheque clearing process used by banks has this key. The image on the page clearly shows the location of the QR and how the layout has been updated to accommodate. The result is full security protection for each cheque, ensuring that the cheque is genuine and that there has been no alteration to the payee or amount details.If you currently infill your own cheques and your software does not have the ability to add the UCN plus. There are two options that PCF can help you with.

- 1. PCF ISF Cheque Software solution. A secure browser based application for cheque approval for in house cheque printing. The software will control not only the template layout, signatures, MICR line etc but will add the UCN and UCN Plus automatically to all the cheques. This will provide a secure in house production with full audit facilities.

- 2. PCF also can offer bureau service. Simply transfer your payment data through one of our secure data transfer portals and we take care of the rest. Any size production can be handled.

® A registered trademark of CheckPrint Limited, a member of the TALL group of companies. Used under licence